Cayman tax - What's new?

Cayman tax?

The Cayman tax is a tax measure against tax evasion by Belgian residents who are considered to be the founder of a “legal construction” (a trust / low taxed structure abroad).

The Cayman tax includes 3 things:

- Look-through-tax: it taxes the income received by the legal construction as received directly, due to transparency, by the founder;

- Taxation of distributions: distributions made by the legal construction are taxable in the hands of the beneficiary as dividends to the extent that they cannot demonstrate that the distribution represents: -) the equity of the legal construction; -) income that has already been subject to its appropriate Belgian income tax regime.

- Reporting obligation: the existence of a legal construction needs to be mentioned in the personal (or legal entities) income tax return of the founder or any person who received a benefit from the legal construction during the taxable period.

What changed?

A Program Act amending the Cayman tax was published in the Belgian Official Gazette on December 29, 2023. Below we discuss some of the changes.

Expansion of the definition founder

As explained above, all income of a legal construction can be taxed in the hands of the founder of the legal construction (look-trough-taxation). The founder also needs to mention the legal construction in his personal (or legal entities) income tax return.

This new legislation expands the definition of a founder of a legal construction.

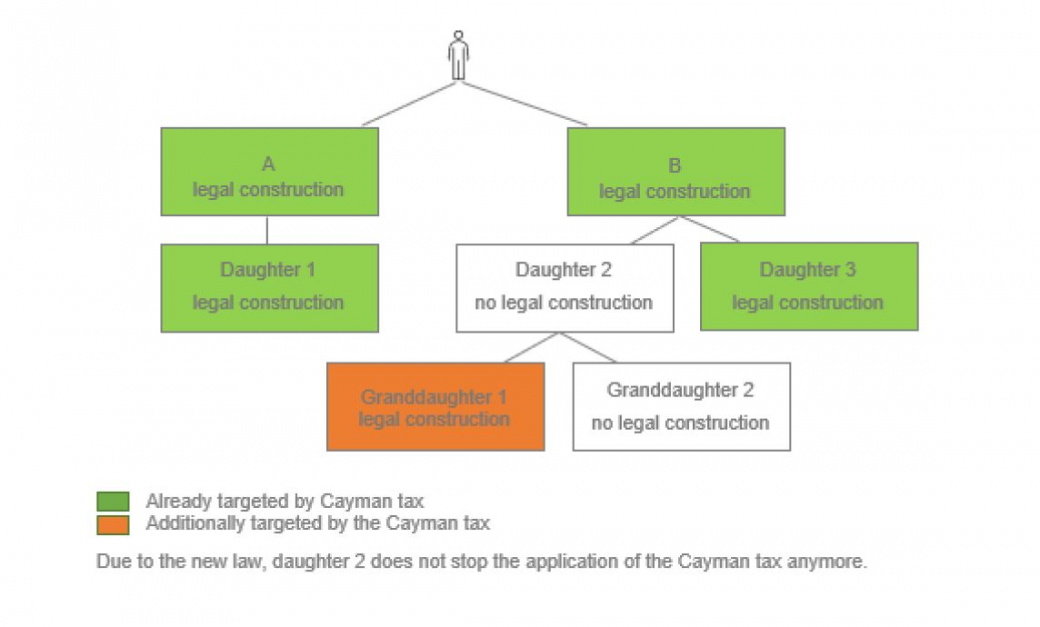

Intermediate constructions

Originally the Cayman tax only applied to daughter companies if the mother company/companies qualified as a legal construction as well. Because of this, it could have been enough to slide a normally taxed company (such as a Luxembourg Soparfi) into the chain to escape from Cayman tax on the underlying companies. This is no longer the case.

Under the new rules it is possible to target chains of legal constructions even if not all entities of the chain are considered to be legal constructions. This will result in more people being considered as a founder of a legal construction and thus being subject to the Cayman tax.

Rebuttable presumption

In the absence of information about a foreign construction, nowadays tax authorities are experiencing difficulties when determining the founder of a legal construction. Because of this, the new legislation provides a new rebuttable presumption.

Belgian residents that qualify as ultimate beneficiary of a legal construction, based on the Belgian or a foreign UBO-register, may be assumed to be the founder of that legal construction under the new legislation.

The new law states that all relevant facts and circumstances must be taken into account when applying this presumption. The explanatory memorandum explains as follows: this presumption should only be applied in cases where the resident "does not cooperate" with the investigation or if the investigation "does not reveal the concrete facts and circumstances that explain why this taxpayer appears in the UBO-register".

Dedicated undertakings for collective investment

Belgian residents holding shares or units of a dedicated investment fund (e.g. a UCI and AIF) are subject to the Cayman tax if the fund (compartment) is held by one or more connected persons (family members or controlled legal entities).

Until December 31, 2023, the Cayman tax only applied when the investment fund was exclusively held by one person or by connected persons. Unless anti-abuse rules applied, it was sufficient that a third (not-connected) person participated in the shareholding to exclude the founder / beneficiary from the application of the Cayman tax. The participation of this not-connected person could be rather limited.

To end such avoidance, the new rules state that a dedicated fund can only be excluded from the application of the Cayman tax if, minimum 50% of the shares or units are held by one or more not-connected persons. This limit should be assessed for each individual compartment.

The new rules also include 2 situations wherein the presumption applies that the condition “more than 50% connected persons” is met:

- When the asset manager receives specific instructions to buy or sell certain financial instruments, from the persons holding the rights of that (sub-)fund; or

- In case no independent asset manager has been appointed.

Substance exemption

If a legal construction is established in a state with whom rules regarding the avoidance of double taxation or exchange of information on tax matters apply, it can be possible to prove that the entity exercises a substantial economic activity. If this is the case, the founder of the legal construction will not be taxed on the basis of the look-through-principle and distributions made by the legal construction will not be taxable in the hands of the beneficiary as a dividend. The exit tax (see below) will equally not apply in this case.

The new legislation now describes what is to be understood by “exercising an economic activity”. It must involve “the offering of goods or services on a given market”. To prevent abuse, it is clarified – as in previous legislation – that:

- this substantial activity does not involve the management of the private assets of the founder or any of the founders of the legal construction; and

- the substantial economic activity needs to be supported by personnel, equipment, and premises as well as goods (the latter was added in the new legislation). Where previous legalisation stated that the size hereof needed to be proportional to the aforementioned economic activities, the new law stipulates that the income should primarily be generated from these assets.

1-in-3 rule

In general, the definition of a legal construction needs to be verified on an annual basis to determine whether (a) there is a look-through tax, (b) there is a reporting requirement and (c) the distributions of the legal construction are taxed as dividends.

This allowed structures to place themselves outside the scope of the definition of a legal construction (by realising sufficient taxation) for a certain year and to distribute all assets of the legal construction in that specific year, without taxation as a dividend.

To prohibit this, the new legislation stipulates that distributions will be taxed as dividends when an entity qualified as a legal construction in at least one of the three previous taxable periods.

Exit tax

To prevent Belgian residents moving abroad or restructuring assets (only to avoid the Cayman tax), an exit tax will apply in the hands of the founder of the legal construction when:

- the founder of the legal construction moves his tax residence abroad; or

- the economic rights, shares or assets of the legal construction are contributed to another legal construction/entity or transferred to a state or jurisdiction other than Belgium.

Unlike the previous legislation, transfers to states with whom rules regarding the avoidance of double taxation or exchange of information on tax matters apply are no longer excluded under the new rules. Every transfer outside of Belgium is endorsed. The founder will thus be taxed on the undistributed profit of a legal construction as a dividend, as if this income was granted or made payable to the founder.

Equal to the taxation of dividends, this exit tax will be applicable on income obtained (a) during the Belgian period as well as (b) when the founder of the legal construction lived abroad.

The payment of the exit tax that is due on undistributed profits may be done on a staggered basis over five years, if it concerns a legal construction established in a member state of the European Economic Area.

Avoidance of double taxation on dividends – impact on capital gains

Distributions made by a legal construction can be exempted from the Cayman tax if this income has already undergone its tax regime in Belgium (on the basis of the ‘look-through-principle’ or ‘the exit tax’).

Under previous legislation, it was sufficient that the income could have been taxed in Belgium (when it was allocated to a Belgian founder on the basis of the ‘look-through-tax’ or the ‘exit tax’). An actual taxation in the hands of the founder was not required.

So, even if there was no actual taxation (because the founder fell out of scope of our tax legislation or benefited from a tax treaty, ...) an exemption applied when this income was distributed by the legal construction.

Consequently, the application of the Cayman tax could actually be beneficial for the founder, as he/she could obtain an exemption twice (upon receipt of the income by the legal construction and upon distribution). This would not have been possible if the structure was not targeted by Cayman tax.

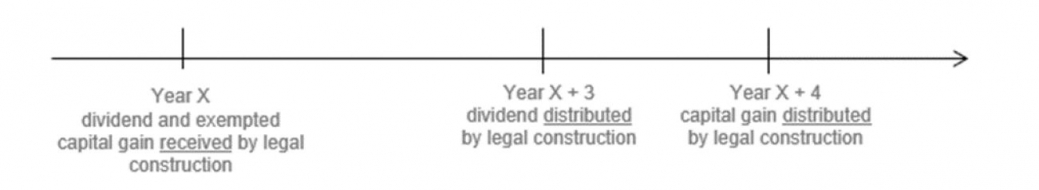

As this was not the intention of the Cayman tax, law now stipulates that the exemption for distributions is only applicable if the income has effectively been taxed at the moment of the look-through-taxation or exit-taxation. Capital gains on immovable property, as well as capital gains on shares obtained through a legal construction within the scope of normal management of private assets, remain untaxed when the legal construction receives them (look-through-taxation),

but are no longer distributed without additional taxation.

Year X: Under the principle of the look-trough-tax the founder will be taxed as if he received the income himself (i.e.

taxation on the dividends, but not on the capital gains realised within normal management of private assets).

Year X + 3: The distribution of dividends by the legal construction will be exempted from taxation, because the dividend has already been taxed in year X.

Year X + 4: Due to new law, the distribution of capital gains by legal construction will be taxed as dividend, since no tax was levied in year X. Under previous legislation, this distribution would have been exempted from tax.

Distribution in the same calendar year

Previously, it was not clear whether income obtained and distributed in the same year would be taxed under the look-through-principle or as a dividend.

The Program Act and explanatory memorandum clarify that the income obtained by the legal construction is always taxed transparently, even if it is distributed in the same calendar year.

This is in accordance with the current ruling practice.

Reporting obligation

To get a better insight of the income of legal constructions, the new law provides a mandatory annex to the personal (or legal entities) income tax return. Besides the information that needed to be reported already, the annex should detail:

- The income obtained by each legal construction;

- The amount of the assets of the legal construction at the end of each taxable period;

- The portion of the assets contributed by the founder;

- The distributions made by the legal construction or distributions that are deemed to be made on the basis of the exit tax.

This additional information will allow the tax authorities to verify if the Cayman tax has been applied correctly for each of the legal constructions.

Entry into force

The Program Act entered into force as from January 1, 2024, except for the annex to the personal (or legal entities) income tax return, this is applicable as from assessment year 2024 (income year 2023).

Do not hesitate to contact us if you have any question about this.